You said that Volcker was worried about banks making stupid investments. What’s wrong with banks investing in things? If I had money, I’d be investing in all sorts of things. Even now, a lot of people expect it to get watered down.

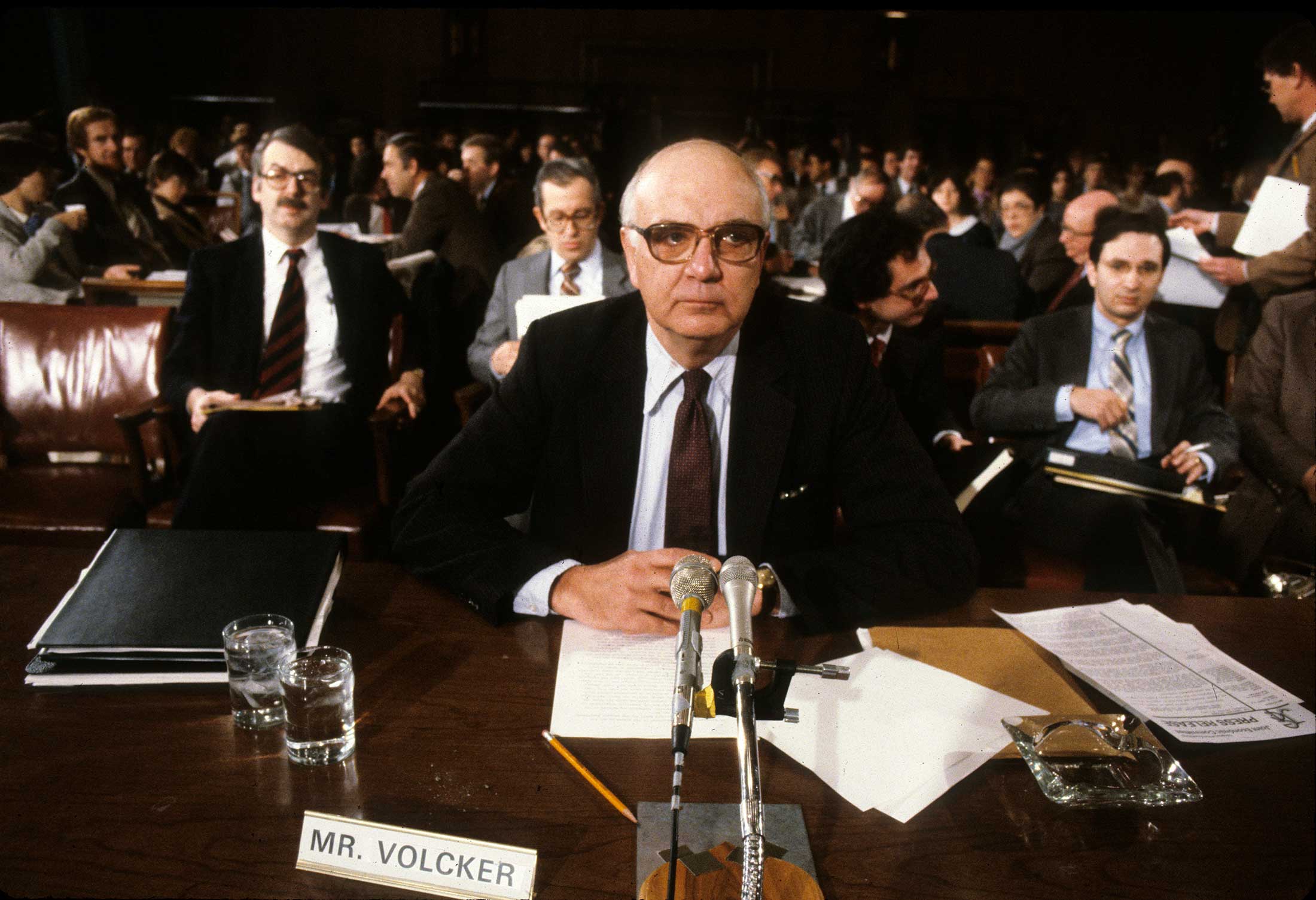

Banks didn’t like it and spammed regulators with nearly 20,000 comment letters, not to mention all the money they spent on lobbyists to fight it. Another reason is that all the agencies insisted on passing the same exact version of the rule, and that took ages of back and forth. The biggest one is that, like the Godfather, the Volcker Rule has powerful enemies. So we’re talking about an eight-year gestation period in some cases.Ī few reasons. Small banks – the ones with less than $10bn in assets – don’t have to start fully cooperating until 2017. Midsize banks, with less than $50bn in assets, have until 2016. And the rules don’t really go into effect until Jfor banks overseen by the Federal Reserve. Volcker first started talking about the rule in 2009, so it’s really more like four years. Maybe they can’t afford mittens.Īlso: three years! Why did it take so long? So why is the Volcker Rule news this week?Īfter three years and many big fights, five big regulatory agencies have voted to pass the rule: the Federal Reserve, the Commodity Futures Trading Commission, the Securities and Exchange Commission, the Federal Deposit Insurance Corporation and the Office of the Comptroller of the Currency. The CFTC actually had a snow day but they voted anyway.Ī snow day? What? There’s barely any snow in Washington. So he (and hundreds of other people) started writing the Volcker Rule. Volcker wanted to find a way to prevent that. Volcker envisioned a day when a bank would make a big, secret stupid bet with its own money, and then it would lose so much money that it would hurt the rest of us: either the bank would be in so much trouble that our deposits would be at risk, or the bank would require a bailout, or both. That was called proprietary trading, and it was kept hidden from the public. Three years ago, when Congress was talking about Dodd-Frank financial reform, he started worrying about something: banks were taking big risks by investing their money in stocks, bonds, commodities and other risky assets. He’s the 86-year-old former chairman of the Federal Reserve and all-around wise man in finance who believes the financial system is not working the way it should be. Paul Volcker – why do we care what he thinks about the financial system? I mean, everyone’s a critic, right? I can’t wait to start ignoring this tomorrow.

0 kommentar(er)

0 kommentar(er)